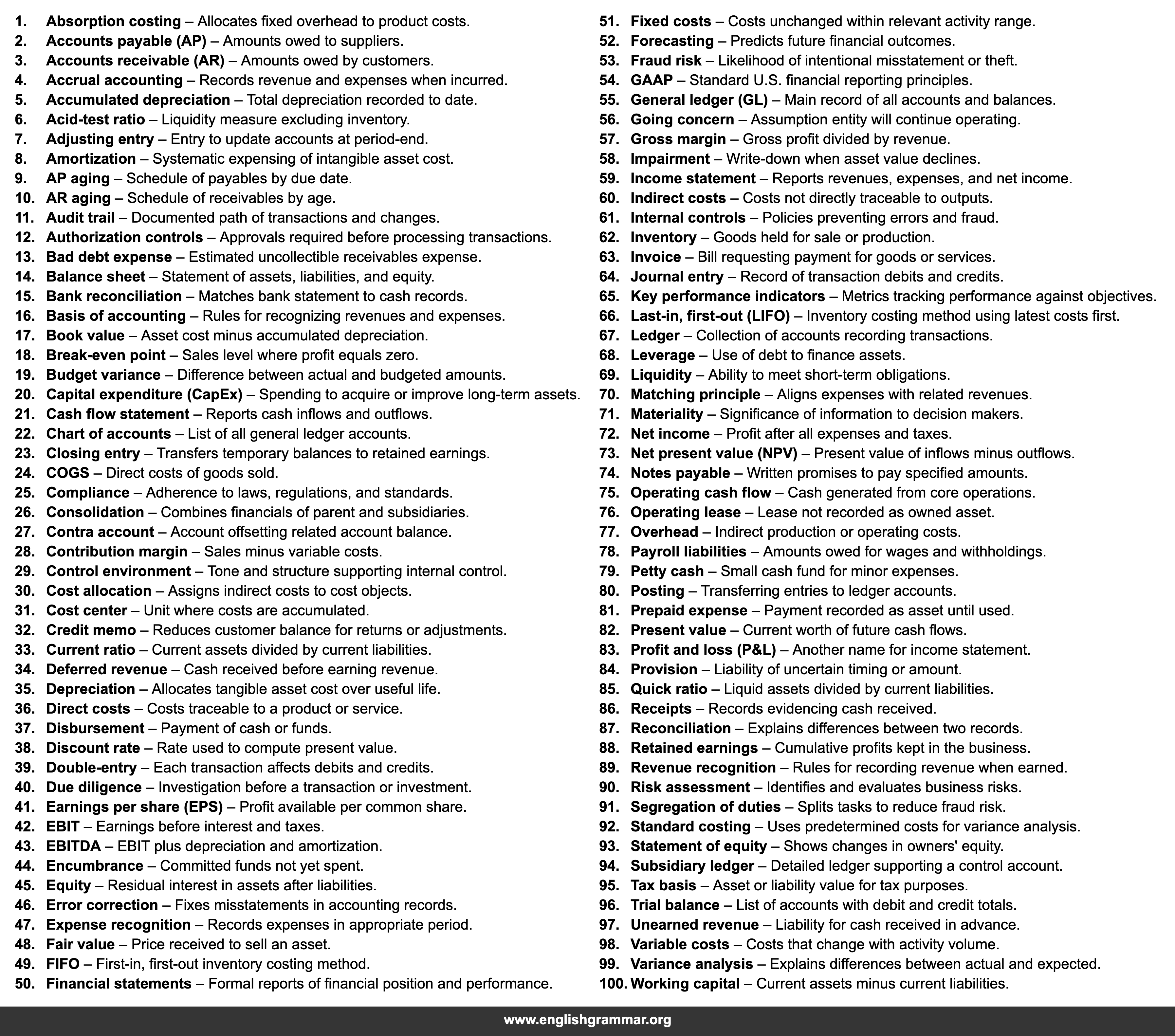

| No. | Term | Definition |

|---|---|---|

| 1. | Absorption costing | Allocates fixed overhead to product costs. |

| 2. | Accounts payable (AP) | Amounts owed to suppliers. |

| 3. | Accounts receivable (AR) | Amounts owed by customers. |

| 4. | Accrual accounting | Records revenue and expenses when incurred. |

| 5. | Accumulated depreciation | Total depreciation recorded to date. |

| 6. | Acid-test ratio | Liquidity measure excluding inventory. |

| 7. | Adjusting entry | Entry to update accounts at period-end. |

| 8. | Amortization | Systematic expensing of intangible asset cost. |

| 9. | AP aging | Schedule of payables by due date. |

| 10. | AR aging | Schedule of receivables by age. |

| 11. | Audit trail | Documented path of transactions and changes. |

| 12. | Authorization controls | Approvals required before processing transactions. |

| 13. | Bad debt expense | Estimated uncollectible receivables expense. |

| 14. | Balance sheet | Statement of assets, liabilities, and equity. |

| 15. | Bank reconciliation | Matches bank statement to cash records. |

| 16. | Basis of accounting | Rules for recognizing revenues and expenses. |

| 17. | Book value | Asset cost minus accumulated depreciation. |

| 18. | Break-even point | Sales level where profit equals zero. |

| 19. | Budget variance | Difference between actual and budgeted amounts. |

| 20. | Capital expenditure (CapEx) | Spending to acquire or improve long-term assets. |

| 21. | Cash flow statement | Reports cash inflows and outflows. |

| 22. | Chart of accounts | List of all general ledger accounts. |

| 23. | Closing entry | Transfers temporary balances to retained earnings. |

| 24. | COGS | Direct costs of goods sold. |

| 25. | Compliance | Adherence to laws, regulations, and standards. |

| 26. | Consolidation | Combines financials of parent and subsidiaries. |

| 27. | Contra account | Account offsetting related account balance. |

| 28. | Contribution margin | Sales minus variable costs. |

| 29. | Control environment | Tone and structure supporting internal control. |

| 30. | Cost allocation | Assigns indirect costs to cost objects. |

| 31. | Cost center | Unit where costs are accumulated. |

| 32. | Credit memo | Reduces customer balance for returns or adjustments. |

| 33. | Current ratio | Current assets divided by current liabilities. |

| 34. | Deferred revenue | Cash received before earning revenue. |

| 35. | Depreciation | Allocates tangible asset cost over useful life. |

| 36. | Direct costs | Costs traceable to a product or service. |

| 37. | Disbursement | Payment of cash or funds. |

| 38. | Discount rate | Rate used to compute present value. |

| 39. | Double-entry | Each transaction affects debits and credits. |

| 40. | Due diligence | Investigation before a transaction or investment. |

| 41. | Earnings per share (EPS) | Profit available per common share. |

| 42. | EBIT | Earnings before interest and taxes. |

| 43. | EBITDA | EBIT plus depreciation and amortization. |

| 44. | Encumbrance | Committed funds not yet spent. |

| 45. | Equity | Residual interest in assets after liabilities. |

| 46. | Error correction | Fixes misstatements in accounting records. |

| 47. | Expense recognition | Records expenses in appropriate period. |

| 48. | Fair value | Price received to sell an asset. |

| 49. | FIFO | First-in, first-out inventory costing method. |

| 50. | Financial statements | Formal reports of financial position and performance. |

| 51. | Fixed costs | Costs unchanged within relevant activity range. |

| 52. | Forecasting | Predicts future financial outcomes. |

| 53. | Fraud risk | Likelihood of intentional misstatement or theft. |

| 54. | GAAP | Standard U.S. financial reporting principles. |

| 55. | General ledger (GL) | Main record of all accounts and balances. |

| 56. | Going concern | Assumption entity will continue operating. |

| 57. | Gross margin | Gross profit divided by revenue. |

| 58. | Impairment | Write-down when asset value declines. |

| 59. | Income statement | Reports revenues, expenses, and net income. |

| 60. | Indirect costs | Costs not directly traceable to outputs. |

| 61. | Internal controls | Policies preventing errors and fraud. |

| 62. | Inventory | Goods held for sale or production. |

| 63. | Invoice | Bill requesting payment for goods or services. |

| 64. | Journal entry | Record of transaction debits and credits. |

| 65. | Key performance indicators | Metrics tracking performance against objectives. |

| 66. | Last-in, first-out (LIFO) | Inventory costing method using latest costs first. |

| 67. | Ledger | Collection of accounts recording transactions. |

| 68. | Leverage | Use of debt to finance assets. |

| 69. | Liquidity | Ability to meet short-term obligations. |

| 70. | Matching principle | Aligns expenses with related revenues. |

| 71. | Materiality | Significance of information to decision makers. |

| 72. | Net income | Profit after all expenses and taxes. |

| 73. | Net present value (NPV) | Present value of inflows minus outflows. |

| 74. | Notes payable | Written promises to pay specified amounts. |

| 75. | Operating cash flow | Cash generated from core operations. |

| 76. | Operating lease | Lease not recorded as owned asset. |

| 77. | Overhead | Indirect production or operating costs. |

| 78. | Payroll liabilities | Amounts owed for wages and withholdings. |

| 79. | Petty cash | Small cash fund for minor expenses. |

| 80. | Posting | Transferring entries to ledger accounts. |

| 81. | Prepaid expense | Payment recorded as asset until used. |

| 82. | Present value | Current worth of future cash flows. |

| 83. | Profit and loss (P&L) | Another name for income statement. |

| 84. | Provision | Liability of uncertain timing or amount. |

| 85. | Quick ratio | Liquid assets divided by current liabilities. |

| 86. | Receipts | Records evidencing cash received. |

| 87. | Reconciliation | Explains differences between two records. |

| 88. | Retained earnings | Cumulative profits kept in the business. |

| 89. | Revenue recognition | Rules for recording revenue when earned. |

| 90. | Risk assessment | Identifies and evaluates business risks. |

| 91. | Segregation of duties | Splits tasks to reduce fraud risk. |

| 92. | Standard costing | Uses predetermined costs for variance analysis. |

| 93. | Statement of equity | Shows changes in owners’ equity. |

| 94. | Subsidiary ledger | Detailed ledger supporting a control account. |

| 95. | Tax basis | Asset or liability value for tax purposes. |

| 96. | Trial balance | List of accounts with debit and credit totals. |

| 97. | Unearned revenue | Liability for cash received in advance. |

| 98. | Variable costs | Costs that change with activity volume. |

| 99. | Variance analysis | Explains differences between actual and expected. |

| 100. | Working capital | Current assets minus current liabilities. |